Header and Detail accounts

This post is also available in: Bahasa Malaysia Bahasa Indonesia

MYOB Header and Detail accounts

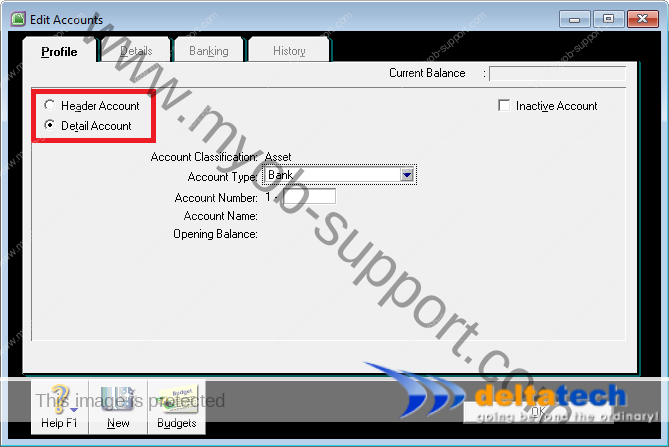

Accounts in MYOB can either be Header or Detail accounts.

In this article, we explain the difference between the two.

MYOB Header accounts

Header accounts are used to group similar accounts.

You cannot record transactions to Header accounts.

In other words, in transaction screens like Spend Money, you will not see or be able to select accounts that have been set as Header accounts.

As an example, if your business has 3 bank accounts, you can use a header account named “Banks” to group these accounts together.

With this, you will not only be able to group the bank accounts together in the Accounts List, you will also be able to see the total of the balances of the 3 bank accounts reflected in the Bank Header account.

Detail accounts on the other hand, are accounts that you can select to record transactions to.

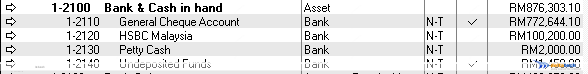

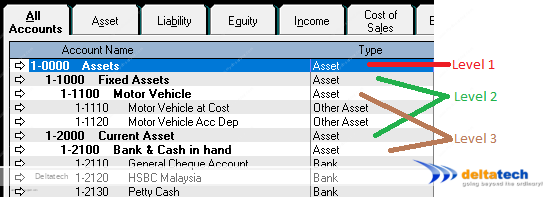

In the above image:

- 1-2100 Bank & Cash in hand is a header account

- 1-2110, 1-2120, 1-2130 and 1-2140 are detail accounts that fall under the 1-2100 header

When viewing the Accounts List in MYOB, accounts in bold are header accounts.

Detail accounts that belong to a header account are indented to the right below the header account.

Also notice that if you total up the balances from 1-2110, 1-2120, 1-2130 and 1-2140, it will be the balance shown against 1-2100.

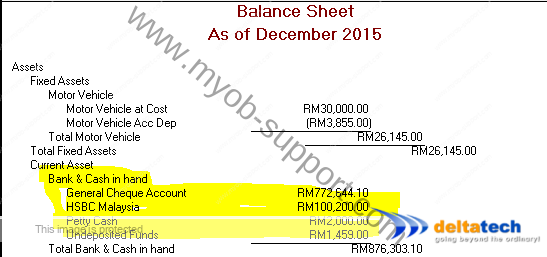

Header accounts are also useful for summarizing accounts for presentation.

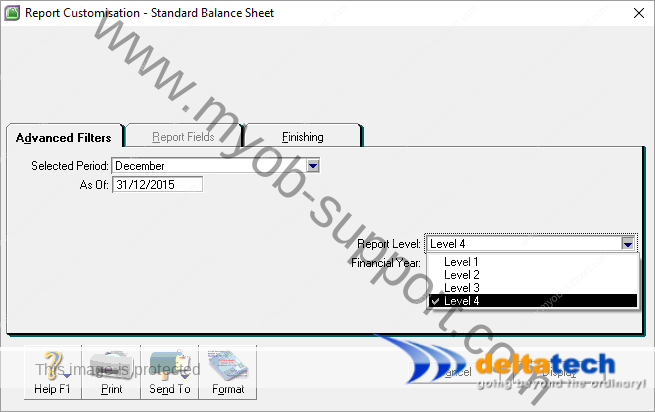

When printing a Balance Sheet for example, instead of printing out details of each of the bank accounts, you can select levels which would then print out only the header and a total.

This type of report is useful when presenting to third parties and you don’t want to disclose the names or the number of bank accounts you have.

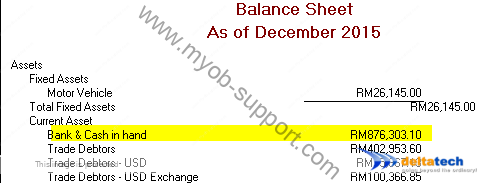

MYOB Balance Sheet report – level 4

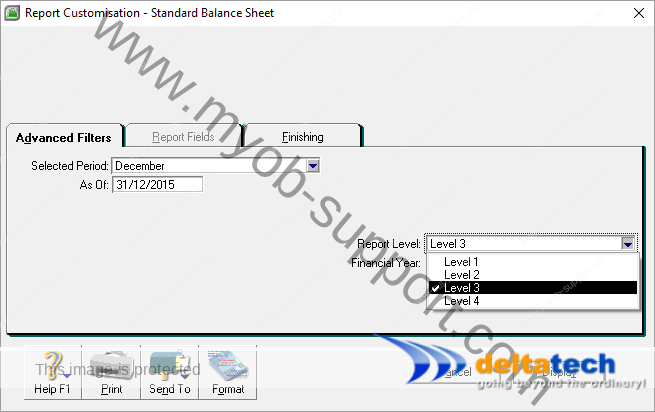

MYOB Balance Sheet report – level 3

The above images are 2 versions of the same report, except the first one shows details, whereas the second one shows only the “Bank & Cash in hand” header account with the total.

MYOB supports up to 4 levels of accounts.

However, some header accounts are created by MYOB and are required.

You can edit the names of these header accounts, but you cannot change the account number, or delete these accounts.

The fixed header accounts in MYOB are:

| Account number | Account name |

|---|---|

| 1-0000 | Assets |

| 2-0000 | Liabilities |

| 3-0000 | Equity |

| 4-0000 | Income |

| 5-0000 | Cost of sales |

| 6-0000 | Expenses |

| 8-0000 | Other income |

| 9-0000 | Other expenses |

If required therefore, you can add up to 2 headers in your chart of accounts.

An example of this is shown in the image.

The Level 1 header, 1-0000 Assets is created by MYOB, and you cannot delete it, whereas 1-1000 and 1-2000, which are level 2 headers can be edited or deleted.

The same applies to level 3 header 1-2100 Bank & Cash in hand.

MYOB Detail accounts

MYOB Detail accounts on the other hand, are accounts that you will be posting transactions to.

These accounts are not displayed in bold, and are available for selection when recording transactions.

Before creating your chart of accounts in MYOB, decide on how you want to structure it, i.e. how you will group your detail accounts with headers and sub headers.

This will make it easier for you to manage your accounts as well as generating reports.